Bank of Canada Raising Rates in September?

Will the Bank of Canada increase interest rates on September 6, 2023? How far will they go?

My call is for a 0.25% increase at the next meeting. Not because I think they should increase rates but because I think they will.

Here’s the reason that they should NOT increase rates:

- Raising rates takes time to filter through the economy.

- By my calculation, only 5.72% of mortgages increased rates as the Bank of Canada increased rates.

- The rest of the mortgages have to wait until maturity to see higher renewal rates and that’s about 17% per year.

- Therefore just over 24% of mortgages will have been significantly impacted by the increase in interest rates.

- This number will increase as time goes on.

Here’s some data pointing to deflation:

- The costs that producers and manufacturers pay for products is decreasing

- China is in the middle of a slowdown and unwinding leverage

- Benjamin Tal of CIBC said that when excluding mortgage and rent costs that core inflation was below the 2% target

Given this information I think that there is no reason to increase interest rates, particularly when core inflation minus the cost of mortgage and rent costs is below the 2% target.

Higher rent and mortgage costs are deflationary, NOT inflationary in this case.

Why would the Bank of Canada increase interest rates?

In short, because inflation is not coming down at the pace that they had hoped for.

During the 1970’s inflation they eased rates too soon and inflation shot back up. They’re afraid of making that same mistake.

They’ve stated that they will do what it takes to get inflation down to 2%, all the way down to 2%.

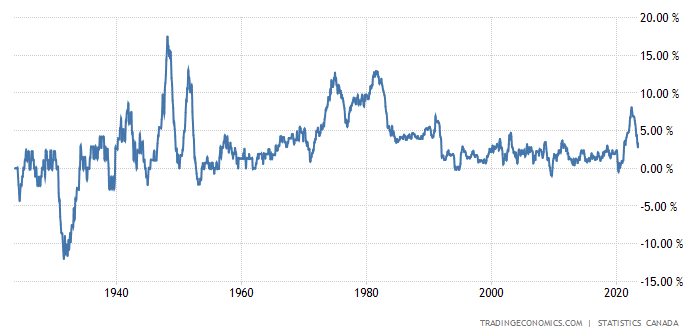

Canadian Headline Inflation

July’s core CPI inflation read, which strips out the more volatile items of food and energy, was at 3.2%. This is higher than what the Bank of Canada was hoping for and higher than the spring’s trend which pointed to a 2.2% rate.

This gives them the justification to increase rates in September.

Given the discussion by the Bank of Canada governor at the last meeting in July, I believe he has the intention of increasing rates again.

Bottom line

Bank of Canada is likely to increase in on 2023-Sep-06

Conclusion

I expect the Bank of Canada to increase interest rates in September.

I also expect the Bank of Canada to have less justification for increasing rates going forward but that doesn’t eliminate the possibility of more hikes.

To me, this feels a lot like 2007 where inflation was rising and we kept increasing interest rates. Even in the face of higher rates, the economy kept growing and the stock market kept going higher.

I expect the Bank of Canada to finish their rate hiking cycle soon and be in need to quickly lower interest rates in the later half of 2024 or sometime near then.

Next Steps

Here’s what to do about it:

1) Any cash, invest in safe but high yielding investments (ask us how)

2) Be sure to negotiate any mortgage renewal rates (ask us how)

3) Be spending aware and make sure that every dollar has a purpose (ask us how)

Until next time,

Trevor

___________________________________________________

Trevor Dale, CFA

CEO, TK Dale Wealth Inc.

Portfolio Manager, TK Dale Wealth Management Inc.

Life Insurance Agent, TK Dale Wealth Insurance Inc.

Mortgage Broker, TK Dale Wealth Mortgages Inc. Lic. #13359

#7-17075 Leslie St., Newmarket, ON L3Y 8E1

*Disclaimer: Please note that this communication contains forward looking information. We do not guarantee or warrant these statements and cannot guarantee that the outcomes will occur. This is not individual advice and you should seek the help of a licensed professional. This is not intended to solicit residents outside of Ontario, Canada. We do not provide tax or legal advice. Securities mentioned in this communication are not recommendations. We do not endorse nor recommend any securities mentioned. This is not financial advice. We recommend seeking the help of a licensed professional prior to making investment and financial decisions.