Violence in the Markets

2023-11-07

October turned out to be consistent with it’s reputation. Sell off in the beginning of the month and rally in the second part of the month. This appears to be a turning point and as a result, we reallocated most portfolios to reflect this change. Details on the trade are below.

(Note: the following is not an investment recommendation. Seek the help of a licensed professional prior to acting on this information. This is provided for educational purposes only.)

One notable is that the last 5 trading days in October were violent. The catalyst? US Federal Reserve Chair Jerome Powell indicated that they want to hold rates here to see how things progress for a little bit.

This was taken by the market as near peak interest rates.

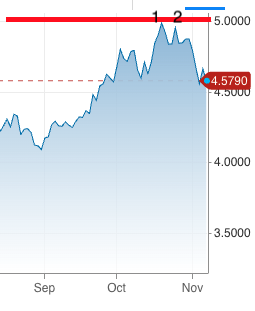

Look at the lead up in this chart of the US government 10 year bond:

US 10 Year Government Bond Yield to 2023-11-07

This was parabolic and usually when things go parabolic in the market, they turn violent in the opposite direction.

In a mere 4 trading days between Nov. 1 to 7:

- S&P 500 up 4.5%

- US banks, including regionals ETF ZUB up 6.3%

- Utilities up 6%

These are all interest rate sensitive sectors that had outsized movements.

Look at how the 10 year bond refused to punch above the 5% yield mark after making two recent attempts only to fall back to lower levels:

US 10 year government bond failing to break above the 5% yield twice:

Buyers swept in and picked up value.

For a while now I’ve been watching and waiting for bonds to be a good investment choice again.

Last week was my capitulation.

What I didn’t expect was levels to change from near 4.88% to 4.56% in three days.

In bond world, that’s massive!

Question:

Is this just a pullback only to drive higher or is this a new direction?

Here’s my list of reasons as to why I feel that we are near the end of hiking cycle from an economics perspective and heading in a new direction:

Note: yoy stands for year over year. These are all Canadian data points unless otherwise stated.

- Average hourly earnings increasing but this is typical for late cycle as inflation has caused wages to be renegotiated. This poses a risk to fuelling inflation but is more likely an indicator of late cycle inflation.

- Full time employment is on a down trend. Data is choppy though.

- Unemployment rate is ticking up quickly at 14% above lows from January and well above the 3 year lows. This is near pre-pandemic averages but the direction is upwards.

- Manufacturing has been in contraction territory for the last year with the exception of Jan and Feb of 2023.

- Canadian GDP is now mostly flat. Calls for a technical recession are climbing.

- Narrative out of the Bank of Canada is softer. Carolyn Rogers, senior deputy governor, is increasingly more vocal on being softer.

- Yields jolted up in October and fell after Powell’s November 1 speech… 35 bps on the US10yr in about 2 days. This is a violent move for bonds.

- Retail sales yoy have been steadily decreasing this year with the index most recently at 1.64%.

- Oil is down yoy but will likely pick up yoy because of $73 prices in March, May, June and July.

- On an inflation adjusted basis, oil is relatively cheap.

- With respect to the Bank of Canada forecast, core inflation is higher than expected, GDP is trending lower than expected. Both by about 1% each.

If the economy is turning and interest rates are expected to fall, the next question is what bonds to buy? Options are: short term, long term, government, corporate, Canadian, somewhere else, a mixture or any combination of these?

My preference is for Canadian bonds because:

- The Canadian economy is a lot more leveraged than many others, which will have less tolerance for higher rates.

- Mortgage interest rate reset times are shorter in Canada relative to many other places. 5 years or less in Canada compared to 30 in the US.

- As the global economy slows, Canada will likely slow more.

These may sound like bad things… and they are from an economic perspective, but they are good things from a bond market perspective.

As a result I sold out of the high yielding high interest ETF, ticker CSAV.to for some or all of the exposure, depending on client objectives. I was using CSAV as our bond allocation instead of actually owning bonds. This was because bonds fall in value during times of rising interest rates.

In it’s place I bought long dated Canadian government bonds in the form of XLB.to, the iShares Core Canadian Long Term Bond Index ETF.

Why?

- Economic reasons listed above preference a drop in Canadian interest rates

- The extra yield to take on corporate credit risk is not that much extra than government bonds in my opinion

- The markets move in big pendulum swings most of the time and if I want interest rate exposure, called duration risk, then longer term bonds will have more of it than short term bonds.

- At a yield of over 4%, I only need to get a 2% pick up in prices in order to match current cash rates. I think over the long term that this will be easy to do.

Conclusion

To sum up my thoughts, even if I am early in the drop in bond yields, I believe that they will ultimately drop which will drive bond prices up.

I can’t say for certain what will happen in the short term but I’m very confident over the longer term in the direction of interest rates.

Reach out if you have any questions.

Don’t forget to try our SLOMA Course

Spend Less, Own More Assets.

Until next time,

Trevor

___________________________________________________

Trevor Dale, CFA

CEO, TK Dale Wealth Inc.

Portfolio Manager, TK Dale Wealth Management Inc.

Life Insurance Agent, TK Dale Wealth Insurance Inc.

Mortgage Broker, TK Dale Wealth Mortgages Inc. Lic. #13359

#7-17075 Leslie St., Newmarket, ON L3Y 8E1

*Disclaimer: Please note that this communication contains forward looking information. We do not guarantee or warrant these statements and cannot guarantee that the outcomes will occur. This is not individual advice and you should seek the help of a licensed professional. This is not intended to solicit residents outside of Ontario, Canada. We do not provide tax or legal advice. Securities mentioned in this communication are not recommendations. We do not endorse nor recommend any securities mentioned. This is not financial advice. We recommend seeking the help of a licensed professional prior to making investment and financial decisions.