Portfolio Changes: Navigating the Shifting Tides of 2023

During this month, we made adjustments to our portfolio exposure by reducing our Canadian dollar-hedged position in the S&P 500 and replacing it with US dividend stocks that are also Canadian dollar-hedged. I will provide the ticker symbols for the stocks we used below.

Before explaining the rationale behind this change, let’s consider the recent market performance. According to Barron’s, the S&P 500 showed a 15.9% gain in the first six months of the year, with a 6.5% increase in June. The large-cap index reached a new 52-week high and is currently only 7% away from its all-time record.

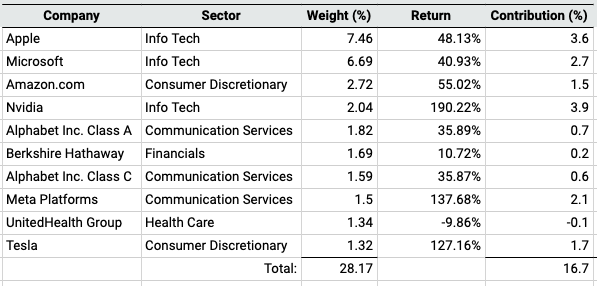

The top 10 stocks in the S&P 500 account for 28.17% of its total value. Although this represents less than one-third of the index, these stocks have exhibited exceptional performance, lifting the overall market while leaving a significant portion of it behind. To visualize this, please refer to the Yahoo Finance return chart that demonstrates individual stock performance of the top 10.

While the worst-performing stock on the S&P 500 saw a negative return of 51.75%, there were 20 stocks that delivered positive returns surpassing 51.75%.

Consider the above chart where we see stocks such as Nvidia with a six month return of greater than 166%.

Additionally, it is worth noting that growth stocks in the S&P 500 have a forward price-to-earnings ratio of 21.4, while value stocks have a ratio of 16.8. Although not the largest difference observed, this discrepancy highlights the richer valuation of growth stocks compared to value stocks.

So, how do their weightings add to the overall performance of the index?

In non-financial terms: It’s a lot.

One way to look at it is that the other 483 stocks netted each other out for a negative 0.8% return while the top 10 did most of the heavy lifting.

Bottom line

A change in portfolios seemed appropriate

Given the turn of the half-year, I believe there may be a shift in market leadership. Typically, technology stocks perform well in two scenarios: when interest rates decrease or when there is increased growth.

However, I anticipate an opposite environment where interest rates will continue to rise beyond market expectations, and growth will be lower than anticipated. While not significantly so, this divergence leads me to adjust our client holdings.

There are three possible scenarios that I see as most likely:

- Tech stocks continue to rally, while the rest of the market remains unchanged (unfavourable for our adjusted trade).

- Tech stocks experience a sell-off as profit-taking occurs during the upcoming rally, with a greater impact on tech stocks compared to value stocks (favorable for our adjusted trade).

- Tech stocks hold steady or experience a sell-off, while value stocks rally to catch up to the market (favorable for our adjusted trade).

I am placing my confidence in the third scenario as the most likely outcome.

This is starting to feel like 2005 / 2006 to me

The current situation reminds me of the period between 2005 and 2006 when inflation was higher, and central banks were increasing interest rates. This led to increased market volatility, but ultimately the markets rallied and continued their positive trend.

One difference now is that many households are renewing their mortgages at significantly higher interest rates than before. However, it takes time for this impact to fully flow through to the market, sometimes taking years to materialize.

In the meantime, inflation remains above target, prompting central banks to continue hiking interest rates. This results in households facing ongoing higher costs for mortgage renewals and refinancing while still dealing with elevated inflation.

At some point, I anticipate that the central banks may overdo the interest rate hikes, leading to financial struggles for consumers.

In this market environment, discipline is crucial. I will not chase short-term advances in tech stocks. Instead, I believe it is important to focus on companies that produce goods over services, prioritize value over growth, and carefully monitor multiples.

Overall, I still believe stocks are a good asset to hold, particularly those aligned with a value-oriented approach. I prefer the composition of US dividend funds over Canadian dividend funds.

As a result, we mostly sold ZUE:CA* and bought ZUD:CA*.

Why not sell and hold cash such as CSAV:CA* that is paying around 5% currently? We would only need 1.23% in capital appreciation in ZUD to beat a second half performance of cash. That seems very reasonable to me.

Are you interested in experiencing this level of portfolio management for your investment portfolio? Inquire today about our financial planning and portfolio management services.

Until next time,

Trevor

___________________________________________________

Trevor Dale, CFA

CEO, TK Dale Wealth Inc.

Portfolio Manager, TK Dale Wealth Management Inc.

Life Insurance Agent, TK Dale Wealth Insurance Inc.

Mortgage Broker, TK Dale Wealth Mortgages Inc. Lic. #13359

#7-17075 Leslie St., Newmarket, ON L3Y 8E1

*Disclaimer: Please note that this communication contains forward looking information. We do not guarantee or warrant these statements and cannot guarantee that the outcomes will occur. This is not individual advice and you should seek the help of a licensed professional. This is not intended to solicit residents outside of Ontario, Canada. We do not provide tax or legal advice. Securities mentioned in this communication are not recommendations. We do not endorse nor recommend any securities mentioned. This is not financial advice. We recommend seeking the help of a licensed professional prior to making investment and financial decisions.